Zillow Group Inc. managed to beat high expectations for the fourth-quarter results by a wide margin, prompting investors to send the stock up double digits to another record and a host of Wall Street analysts to boost their price targets.

The real estate information and transaction website reported late Wednesday fourth-quarter adjusted profit and revenue that were well above consensus analyst expectations. On the post-earnings conference call with analysts, Chief Financial Officer said first-quarter revenue was expected to be about $ 1.1 billion, which compared with expectations of about $ 889 million as of the end of January.

The stock ZG,

“ “Zillow surfing has broken through to a whole new level of pop culture, given that ‘Saturday Night Live’ did a funny and racy sketch about it this past weekend, with Dan Levy in the lead.” ”

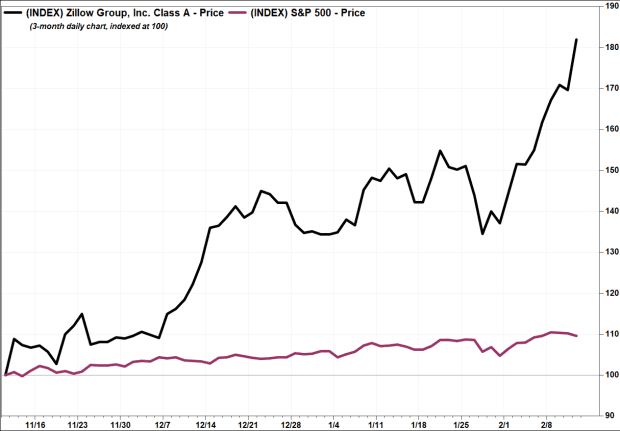

The big post-earnings rally comes despite even as the stock had already soared 23.8% month to date through Wednesday. But Zillow has made a habit of big earnings beats, as before Thursday’s rally, the stock had run up the day after the past five quarterly results were reported, by an average of 12.8%.

On Friday, the stock surged 1.2% to another record. It has run up nearly four-fold (up 293.1%) over the past 12 months, to boost its market capitalization to $ 47.2 billion, while the S&P 500 index SPX has gained 16.6% over the same time.

A big reason for investor enthusiasm?

“We think the Zillow Offers business — and iBuying broadly — is hitting a major tipping point,” wrote Deutsche Bank analyst Lloyd Walmsley in a note to clients.

He said the cost of selling to Zillow Offers is now comparable to using a traditional real-estate agent, but for a lot much more value.

“Stop and think about that for a second. Why would anyone with a more ‘commodity’ type of home use the traditional home selling process versus getting cash from Zillow?” Walmsley wrote. “Zillow may be on the cusp of actually becoming a true marketplace for residential real estate.”

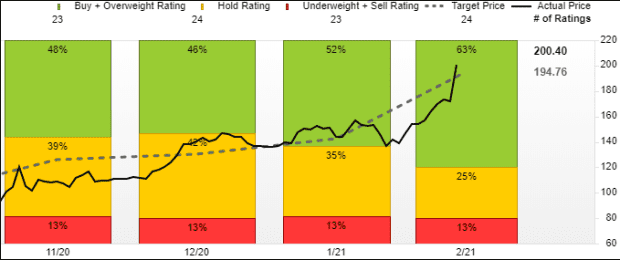

He reiterated his buy rating on the stock, but lifted his price target to $ 225 from $ 202, just three days after raising his target to $ 202 from $ 160.

Zillow Chief Executive Rich Barton said on the post-earnings conference call with analysts that results got a boost from “Zillow surfing,” as engagement across our mobile apps and websites reached levels in 2020 that “we would not previously thought possible.”

“Zillow surfing has broken through to a whole new level of pop culture, given that ‘Saturday Night Live’ did a funny and racy sketch about it this past weekend, with guest host Dan Levy in the lead,” Barton said, according to a FactSet transcript.

Another boost to traffic comes from the new cultural trend that Barton has been calling “the Great Reshuffling,” which has been fueled by the workplace changes resulting from, if not accelerated by, the COVID-19 pandemic.

“Fantasizing about real estate is not new,” Barton said. “What has changed is that more of those people now have the freedom to move. Many Americans, untethered from their commutes and offices, have begun to reevaluate how and where they want to live.”

Don’t miss: Mortgage rates remain at historic lows — will they go lower?

Wedbush analyst Ygal Arounian lifted his price target to $ 218 from $ 167, while reiterating the outperform rating he’s had on the stock since Jan. 6.

“The quarter was a significant proof point that Zillow’s transition to taking a greater role in the transactional elements of the real estate transaction is starting to come together,” Arounian wrote. “But we think Zillow is barely scratching the surface.”

Shyam Patil, an analyst at Susquehanna, kept his rating at neutral, citing concerns over valuation given the recent run up in share prices, but lifted his target to $ 200 from $ 130.

“Zillow continues to benefit from the booming real-estate market and its strong positioning in the online leads and homes businesses, as it showed again in 4Q, with strength across the business,” Patil wrote.

In all, no less than 18 of the 24 analysts surveyed by FactSet have raised their price targets following fourth-quarter results. The average price target is now $ 205.60, which is up 44.5% from $ 142.30 at the end of January.

And CEO Barton said Zillow economists are calling for an even stronger housing market in 2021, as they project growth of 21% to a near-record 6.8 million home sales, plus a double-digit percentage increase in home prices. He believes those higher prices will help address concerns over low inventory, by pulling more inventory onto the market, similar to “just-in-time” inventory management used by warehouse operators.

“The millennial generation is entering prime home buying years and mortgage rates are historically low,” Barton said. “On top of those macro factors, the past year has members of all generations rethinking where they live with a new lens of flexibility and possibility, as the Great Reshuffling continues to take hold.”