Dear MarketWatch,

I’d like to retire in a no (or low) state-income-tax state near water and a state or national park. I want red politics but with (hopefully) legal pot (medical or recreational), and weather that isn’t too cold. I’d compromise on the pot for Texas, if necessary.

I don’t want to be in New Hampshire, Florida or Washington or too close to California.

We’ll have a budget of about $ 5,000 a month and are selling a house worth $ 300,000-ish. I’d love a place with a college vibe and affordable food, too. One of the things that seems to be overlooked in these “where to retire” conversations is how much fresh food costs. I am vegetarian so access to fresh fruits and vegetables is super important to me.

Any ideas?

Sydney

Dear Sydney,

Only seven states don’t levy an income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming. You don’t want Florida or Washington, and Alaska, South Dakota and Wyoming are likely “too cold.”

That leaves Nevada, a purple state where medical marijuana is legal, and Texas, a red state where medical CBD is allowed. Within Nevada, Las Vegas, Reno and Carson City may all be too close to California for your comfort.

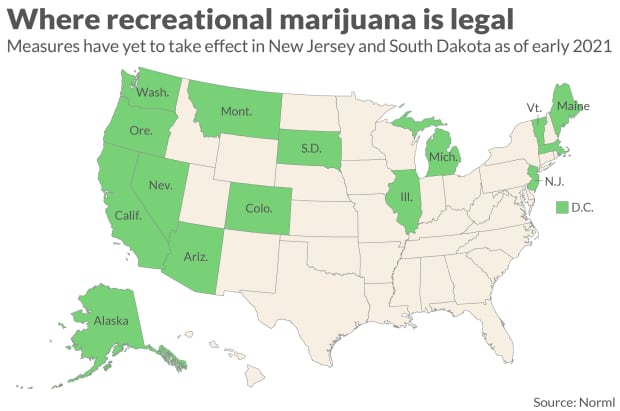

How about red states that do have state income tax but where marijuana is legal? Only 15 states plus the District of Columbia have legalized marijuana as of early 2021 (though the changes have yet to take effect in two of them), according to pro-marijuana advocacy group Norml, and they tend to be blue. Laws of course can change.

One possible match for you is Arizona, though it is looking bluer. Illinois is redder outside of the Chicago area, and southern Illinois would be warmer. The Carbondale area, suggested here, may be an option.

Colorado is purple, has popular national parks — but doesn’t come cheap. Pot is also legal in Montana — but this red state has long, cold winters and may be even less tax-friendly than Colorado.

If you can accept just medical marijuana, Oklahoma, Missouri, Arkansas and Mississippi are among your possibilities. (Mississippi voted in 2020 to allow medical marijuana, though the law has yet to be implemented.) Utah makes the medical marijuana list and has the national parks but unfortunately isn’t that tax-friendly.

But before I make any suggestions, let’s talk more about taxes. Please look beyond whether a state has an income tax. Far more don’t tax Social Security payments, for example. Some offer tax breaks to retired military; others on pension payments. Your sources of income in retirement likely looks far different than when you are working. A free state tax calculator like this one may help you compare your situation across states.

Given how important this is to you, please talk through your findings with a tax professional.

And regardless, state and local governments must find money to pay for services (think property taxes and sales tax) — or leave it to you to pay for them, directly or indirectly, such as through HOA fees.

Also: There is more to picking a place to retire than low taxes — avoid these 5 expensive mistakes

So where could you go? Your budget gives you many options, as the MarketWatch “where should I retire” tool shows. Here are three possibilities that won’t leave you cash-poor.

The sun rises through the trees in the DeSoto National Forest.

iStockphoto

Hattiesburg, Mississippi

You’ll like Mississippi’s tax-friendliness toward retirees: not only are Social Security benefits free of state tax but so are payments from your 401(k), your IRA or pension.

Mississippi also passed a ballot measure in 2020 to legalize medical marijuana, though it still needs to be implemented.

The two big college towns are Oxford (University of Mississippi, also known as Ole Miss) and Starkville (Mississippi State University), but I’m going with Hattiesburg, home to the University of Southern Mississippi. It’s a bigger town — nearly 46,000 people, and 75,000 across Forrest County — so you’re likely to have more choice in produce prices (plus two farmers markets, one downtown, and one for Forrest County). It’s the South, so humid summers are a given. But you’re also less than 90 minutes from the Gulf of Mexico and beaches.

If you move to Hattiesburg, you can take advantage of campus academics in two ways. Those over 50 can take courses offered through the Osher Lifelong Learning Institute on campus. State residents 62 and older can take up to six credit hours of college courses each semester for free, space permitting.

Beyond the university, you can walk, run or bike on the 44-mile Longleaf Trace (a rail-trail that extends north from downtown) and explore DeSoto National Forest. Do follow the 1964 Summer Freedom Trail; Hattiesburg was the largest center in Mississippi for this drive to register African-American voters.

Here’s what your money will buy you in Hattiesburg, using listings from Realtor.com (which, like MarketWatch, is owned by News Corp.)

Springfield, Missouri

This city of 167,000 is in the southwest corner of this conservative state, in the middle of the Ozark Mountains. You’ll get some snow in the winter.

You’ll find no shortage of outdoor options. Numerous state parks, hiking trails and water options are nearby. The Frisco Highline Trail, a highlight of the Ozark Greenways, is a 35-mile trail that runs north to Bolivar.

The National Park Service’s Trail of Tears comes through Springfield, and it runs Wilson’s Creek National Battlefield, the site of the second major battle in the Civil War, just outside Springfield.

There’s also the university side of town. While Missouri State University won’t have the big-time sports that you’ll find at the University of Missouri in Columbia, suggested here, it has more than 24,000 students on the Springfield campus. (You also may not like Columbia’s political leanings.) You can audit a class for free each semester if you’re 62 or older and space is available.

And like in Hattiesburg, you’ll have a couple of farmers markets in addition to the usual supermarkets.

When you want to get away, Branson and its musical shows are less than an hour away. It’s two hours to Bentonville, Ark., suggested here.

These listings on Realtor.com will give you a feel for the local housing market.

The Garden of the Gods rock formations rise abruptly at the foothills of the Rocky Mountains.

iStockphoto

Colorado Springs, Colorado

Let’s go full-on pot and not ignore Colorado, one of the first states to legalize recreational use. True, your Social Security check is taxed — but the state offers a hefty subtraction for any pension and annuity income included in your federal tax return — $ 20,000 for those age 55 to 64, and $ 24,000 for those 65 and older. Social Security qualifies.

Colorado Springs, at the eastern edge of the Rocky Mountains, is the biggest (465,000 people) and snowiest of my suggestions. And while it gets cold at night in the winter, daytime highs then will average in the 40s. Summer highs average in the mid-80s.

You might know it as the home of the Air Force Academy, but the military presence in this city extends to five military installations, including Fort Carson and the North American Aerospace Defense Command, or NORAD, as well as many defense companies.

The University of Colorado-Colorado Springs (10,000 students, plus a “listening in” program for those 55 and older) and the U.S. Olympic & Paralympic Committee are here as well.

Outdoor adventures start in town, with the entrance to the stunning rock formations that are the Garden of the Gods. Pikes Peak, one of Colorado’s 14ers (14,000-foot-plus mountains), is to the west. Within city limits are more than 100 miles of off-street trails; cyclists will appreciate that it is a silver-level bicycle-friendly community. But lots of water options is a bigger challenge; do the other amenities offset that?

When you want to travel, you can choose between the Colorado Springs airport or head less than 90 minutes to the Denver airport

The size of Colorado Springs means you’ll have plenty of shopping choices. While the cost of living here is above the national average thanks to housing costs, according to Bestplaces.net, groceries are not.

The median list price for a home in December 2020 was $ 350,000, according to Realtor.com. But you’ll find many options that won’t have you taking out a mortgage after you sell your current home. Here’s what’s for sale now.

If you’re looking for another conservative Colorado location but with a lower overall cost of living, consider Grand Junction, suggested here.

Readers, where should Sydney retire? Leave your suggestions in the comments section.

More retirement suggestions on MarketWatch

I want to retire in Texas and near freshwater on $ 4,000 a month — where should I go?