A new commodity ‘supercycle’ has started, according to Marko Kolanovic, the highly regarded quantitative analyst at JPMorgan.

The commodity upswing, and oil CL.1,

“We believe that the tide on yields and inflation is turning, which will pose a major risk to multiasset portfolios,” he added.

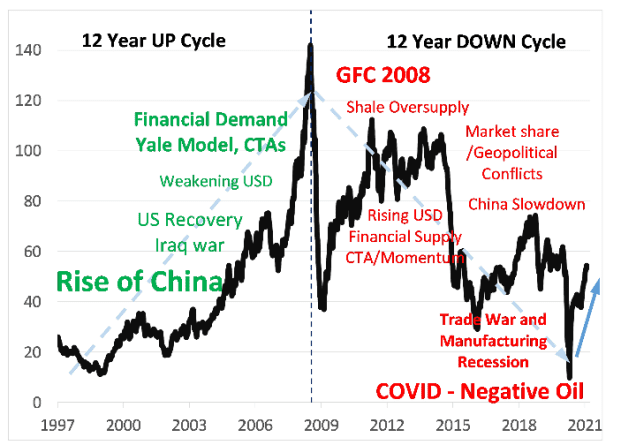

Source: JPMorgan

This will be the fifth so-called supercycle of the last 100 years, following the one that began in 1996 and peaked in 2008, he said.

Like the last one, financial flows may exacerbate the moves in commodities, he added.

Brent crude-oil futures BRN00,