If you’re shopping for a mortgage, undoubtedly you’ve heard the term adjustable-rate mortgage, or ARM as they are commonly referred to. The most common type is a 5/1 ARM, which has a low fixed-rate for the first 5 years and then adjusts annually afterward. This article focuses on adjustable-rate mortgage …

Read More »4 things that make up most mortgage payments

As a first-time homebuyer, you’re likely concerned about the financial obligations that come with owning a home. How much can you expect to pay each month? What about taxes? How can you best protect your investment? Similar to other large purchases, like a car or a boat, homeowners are expected …

Read More »Realtor.com: Why are home prices rising so high? Blame record-low mortgage rates

AP Photo/Steven Senne When the coronavirus pandemic gutted the strongest U.S. economy, many assumed another recession would bring rock-bottom home prices along with it. Instead, home prices defied logical assumptions — and soared to new heights. Paradoxically enough, one of the biggest drivers of the double-digit price hikes is the …

Read More »How to use gift money for your mortgage down payment

All this remote working stuff might have you thinking what many others are thinking, “Why am I paying high rent to live within an easy commute to the office when I can live anywhere?” And if you can live anywhere, you can probably also afford a monthly mortgage payment. It …

Read More »What is APR and How it Affects Your Mortgage

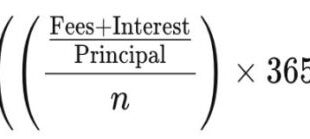

What is the APR? The annual percentage rate (APR) is the interest charged annually on loans and lines of credit. The APR rate is higher than the interest rate because it takes all additional costs and fees into account to give you the true interest rate. The annual percentage rate …

Read More »The Moneyist: I moved into my in-laws’ home. My husband wants to pay his parents’ mortgage, but it will come out of my income. How can I protect myself?

Dear Moneyist, I got married recently and moved into my husband’s house that he shares with his parents. (His name and his parents’ name are on the deed.) Currently, we pay a small amount for rent, but my husband hopes to take on the mortgage of the house over the …

Read More »Could mortgage rates be headed up?

Mortgage rates remain historically low as we enter September. The latest numbers from Freddie Mac show that the average for a 30-year fixed-rate mortgage is standing at 2.93%, relatively unchanged from last week. Freddie Mac economists noted this week that as the yield on the benchmark 10-year Treasury note increases, …

Read More »The Fed takes new approach to inflation: What it means for your savings, credit-card interest — and mortgage rate

The Federal Reserve is shaking things up — which is both good and bad news for consumers. The Fed made some of the biggest changes to its policy in years following an extended review. The central bank has revised its approach to inflation and the labor market in a move …

Read More »Personal Finance Daily: The mistakes to avoid when moving to a state with lower taxes and why low mortgage rates are a double-edged sword

Hi, MarketWatchers. Don’t miss these top stories: Personal Finance Thinking about moving to a state with lower taxes? These are the mistakes to avoid Some states are great to live in, but not so great to die in. 32 states have been approved to offer $ 300 extra in unemployment …

Read More »