Dear Moneyist, For 10 years, my wife and I saved up and, in 2018, purchased our first home before we hit the age of 30. Over the last two years, events have not gone in our favor, especially with COVID-19. In March, I had to have gallstone surgery, and that’s …

Read More »Understanding Upfront Mortgage Insurance (UFMIP)

There are a lot of costs associated with getting a government-backed home loan. The down payment and closing costs can add up to tens of thousands of dollars. But there’s one cost you need to prepare for, the upfront mortgage insurance premium (UFMIP). This article will look at what upfront …

Read More »Everything you wanted to know about PMI (private mortgage insurance)

Back in October, we wrote two blog articles about mortgage terms that you should get to know if you’re in the market for a house. Check them out here and here. In one of those posts, we touched on private mortgage insurance, or PMI, but thought it merited a deeper …

Read More »What’s the Ideal Debt-to-Income Ratio for a Mortgage?

When buying a mortgage, your debt-to-income ratio determines how much you will be approved for. The maximum DTI ratio for most loans is 43%, and in some cases, lenders will allow up to 50%. This article looks at debt-to-income ratios to find out the ideal ratio when buying a house. …

Read More »Mortgage rates drop again, housing hits the gas

For 17-straight weeks, the 30-year fixed-rate mortgage interest rate has averaged below 3%. This week the Freddie Mac 30-year fixed-rate mortgage average dipped to another historic low, the thirteenth this year, hitting 2.72%. Freddie Mac’s Chief Economist Sam Khater cited weak consumer spending as the reason for the decline. Historically …

Read More »How to Negotiate Your Mortgage Rate

Can you negotiate your mortgage rate? Yes. Of course. Anything can be negotiated including the closing costs if you know how to do it. This article details exactly what you need to do to get the best deal on your mortgage loan. Check Rates and Compare Loan Offers from Multiple …

Read More »Home Equity Conversion Mortgage (HECM)

If you’re at least 62 years old and your home is paid off, or you have a lot of equity in your home, you may be able to use your convert your equity into a stream of monthly income or a line of credit. This article takes an in-depth look …

Read More »FHA 245(a) Growing Equity Mortgage Guide

Do you expect your income to increase in the next few years? Section 245(a) Loans (Graduated Payment Mortgage Program) helps borrowers whose income is expected to rise, buy a home sooner by making mortgage payments that start off small and increase over time. This article will take an in-depth look …

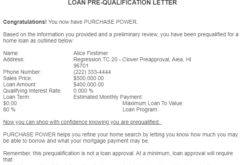

Read More »Mortgage Prequalification vs Preapproval

Before you start making offers on houses, you will want to be pre-approved for a mortgage. Being pre-qualified isn’t enough. This article will focus on the key differences between mortgage pre-approvals and prequalifications. Rate Search: Get Pre-Approved and Check Today’s Mortgage Rates What is a Mortgage Prequalification? To prequalify someone …

Read More »