Ready for this week’s retirement investing pop quiz? In what kind of bonds should you invest the fixed income portion of your portfolio if you thought that a huge economic downturn was just around the corner—U.S. Treasurys or High-Grade Corporate Bonds? The standard answer from most financial planners is the …

Read More »Mark Hulbert: Hope to retire someday? See if you can answer these six simple questions

So you think you’re financially astute? Then try taking the following financial literacy test containing just three basic questions about interest rates, inflation and diversification. Despite being quite elementary, only 34% of adults aged 38 to 64 are able to answer all three correctly. Among millennials this percentage is just …

Read More »Mark Hulbert: Wondering how much your Social Security check will increase next year?

Are you happy or sad that your monthly Social Security check next year will be approximately 1.2% higher than it is this year? Your answer no doubt depends on whether you look at the glass as half full or half empty. Had the Social Security Administration set next year’s COLA …

Read More »: Former Bank of England governor Mark Carney joins asset manager that owns New York’s World Financial Center

Carney became the governor of the Bank of Canada in 2008 and is widely credited with successfully steering the country through the financial crisis. Peter Summers/Reuters Mark Carney is taking his first job since leaving the top post at the Bank of England earlier this year, returning to the private …

Read More »The Wall Street Journal: Facebook’s Mark Zuckerberg stoked Washington’s fears about TikTok

When Facebook Inc. Chief Executive Mark Zuckerberg delivered a speech about freedom of expression in Washington, D.C., last fall, there was also another agenda: to raise the alarm about the threat from Chinese tech companies and, more specifically, the popular video-sharing app TikTok. Tucked into the speech was a line …

Read More »Mark Hulbert: Retirees should consider today’s most unpopular investment — here’s why

Have you ever wondered what investment today is the most out of favor? Most of us never even ask this question, since such investments by definition don’t even appear on our radar screens. But, as contrarians constantly remind us, we are vulnerable to making big mistakes by blindly following the …

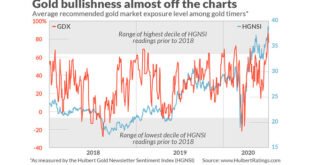

Read More »Mark Hulbert: Gold timers have rarely been more bullish than they are today — that’s a bad sign

A big test for contrarian analysis is brewing in the gold pits. That’s because bullishness among gold market timers has rarely been higher than it is today. Since 2000, which is when I began tracking the average recommended exposure level among such timers, optimism about gold was higher on just …

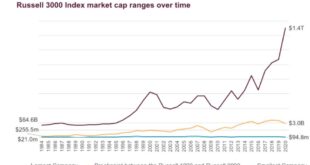

Read More »Market Extra: Will quadruple witching mark the start of a rocky stretch for U.S. stocks? It may already have

Quadruple witching, a pandemic, a recession, and a stock market that is looking for reasons to add to an epic recovery from the impact of the coronavirus. Could those factors make for a volatile cocktail for the stock market in coming days and weeks? Quadruple witching, occurs on the third …

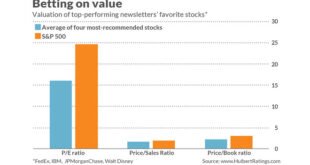

Read More »Mark Hulbert: These 4 stocks are investment pros’ favorites — and not one is a ‘FAANG’ stock

It takes guts to be a value investor these days. But the top-performing investment newsletters have no shortage of courage. By value, I’m referring to stocks that are out of favor, trading for relatively low ratios of price-to-earnings, book value, sales, and so forth. Value’s opposite is growth: Stocks in …

Read More »