Your credit rating has an enormous influence on your financial stability. A borrowers’ credit score will determine whether they are approved for a loan or credit card. It also determines the interest rate. Borrowers with bad credit will have a more difficult time getting approved for loans and the ones …

Read More »Is a low credit score keeping you from getting a mortgage during COVID-19?

Credit scores are a pivotal part of the home-buying process. Not only does your credit score determine if you qualify for a loan, but it also determines your mortgage terms, most importantly, your interest rate. First-time homebuyers often jump into the process of looking to buy a home without really …

Read More »Cash-out refi vs home equity line of credit. What’s the difference?

Whether you’re looking to remodel your home, consolidate your debt or pay an unforeseen expense — it’s only natural to consider tapping into your greatest source of wealth: The equity you’ve already invested in your home. For many, it’s a much safer option to get the cash you need than …

Read More »Home Improvement Loans with Bad Credit

Do you need a loan to make renovations or repairs to your house? There are several types of renovation loans that allow you to get a loan using your equity as collateral. But, what credit score is needed for a home improvement loan? Rate Search: Check Today’s Refinance Rates Credit …

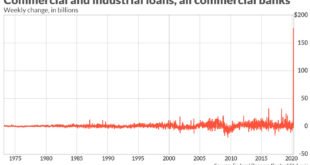

Read More »American businesses are tapping their credit lines at the fastest pace ever

As business activity jerked to a halt in March, American companies began using the credit lines they took out from banks to stay afloat. The chart above shows the week-over-week changes in usage of what’s known as “commercial and industrial loans,” and as BCA Research analysts commented in a Tuesday …

Read More »Market Extra: How the Fed’s latest crisis-era credit facility aims to finally calm rattled markets

Only hours after deploying one crisis-era funding facility, the Federal Reserve on Tuesday unleashed another, potentially more powerful weapon that gives primary dealers on Wall Street cheap loans to snap up a broad array of bonds and stocks. It has an aim of freeing up space on dealer’s balance sheets …

Read More »Upgrade: I’m 59, and my husband and I earn $500,000 a year — but have credit card debt and nothing saved for retirement. What should we do?

Dear Catey, My husband is 65 and a lawyer and partner in his firm with a thriving practice; I am 59 years old. We have three children (more on that below), and I was fortunate to be a stay-at-home mom. I now work part time, which is essentially just “play” …

Read More »Upgrade: I’m 40, will get a pension and have $60,000 saved for retirement. Should I borrow from it to pay off $17,500 in credit card debt?

Dear Catey, I am a 40-year-old law-enforcement officer and hope to retire in 13 or 14 years. At that time, I will have 30-plus years on the job with a pension giving me 70% of my current income with a cost-of-living annual percentage increase around 2% or 3%. Additionally I …

Read More »