MARKETWATCH FRONT PAGE Wall Street’s calendar trading patterns aren’t worth planning your days around. See full story. We want to retire in a place with a low cost of living, no humidity and no colder than 50 degrees — I freeze easily! Where should we go? The house budget is …

Read More »Key Words: Strategist overseeing $124 billion in assets hasn’t been this bullish in a long time — here are two of her favorite investments for 2021

“ ‘We’re the most bullish on the market that we’ve been in about a year.’ ” That’s Meghan Shue, head of investment strategy at Wilmington Trust, explaining to CNBC why she’s optimistic that the stock market has some upside over the next nine to 12 months. She said a combination …

Read More »The Ratings Game: GE stock rises to 9-month high as BofA analyst gets a little more bullish

AFP via Getty Images Shares of General Electric Co. rose Friday toward a nine-month high, after BofA Securities analyst lifted his stock price target by 18%, amid a more upbeat outlook on the industrial conglomerate’s health care business as COVID-19 cases rise globally. The stock GE, +2.64% reversed an earlier …

Read More »Balancing a bullish market with bleak economic outlook

Right now, there are two sides to the economy: Wall Street and everything else. Big tech stocks continue to grow and have pushed the S&P 500 to a record high this week. The Nasdaq also hit all-time highs thanks to FAANG stocks. Facebook, Alphabet, Amazon, Netflix and Google dominate the …

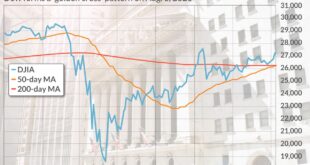

Read More »Market Extra: A bullish ‘golden cross’ forms in the Dow industrials

A golden cross formed in the Dow Jones Industrial Average DJIA, +0.68%, more than five months after a bearish chart pattern materialized in the aftermath of the carnage wrought by the COVID-19 pandemic. A golden cross occurs when the 50-day moving average for an asset price trades above the 200-day …

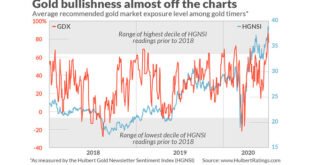

Read More »Mark Hulbert: Gold timers have rarely been more bullish than they are today — that’s a bad sign

A big test for contrarian analysis is brewing in the gold pits. That’s because bullishness among gold market timers has rarely been higher than it is today. Since 2000, which is when I began tracking the average recommended exposure level among such timers, optimism about gold was higher on just …

Read More »