Student-loan borrowers won’t have to resume payments on their federal direct student loans until October, the incoming Biden administration announced Wednesday.

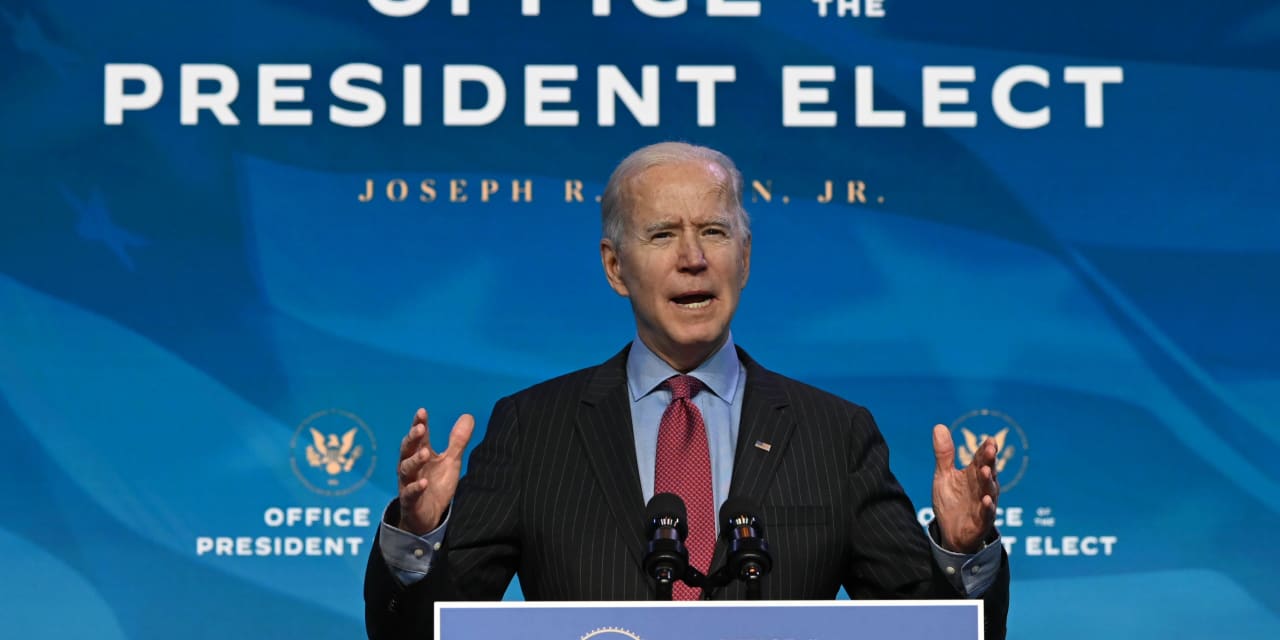

After he’s sworn in as President, Joe Biden plans to ask the Department of Education to “consider immediately” extending the coronavirus-era pause on student-loan payments and collections until at least Sept. 30, 2021. Transition officials announced earlier this month that they planned to extend the student-loan payment pause, which was set to expire on January 31, but hadn’t specified the date when payments would resume.

“This is a meaningful pause to give borrowers some piece of mind for right now,” said Persis Yu, the director of the Student Loan Borrower Assistance Project at the National Consumer Law Center. “Hopefully what this means is we’re going to take this time to really get this system in better shape for when we do resume payments.”

Borrowers and advocates have been on edge for months about the possibility of resuming payments as the freeze continued to be extended in a stop-gap fashion. Given that the pandemic’s economic impacts haven’t subsided, they’ve been concerned that borrowers will face financial and administrative challenges resuming payments.

The uncertainty around the payment pause also created an operational challenge for student loan servicers, who are charged with turning the entire student loan system off and on — an unprecedented task.

The freeze originally began in March 2020 and was set to expire in September of 2020. President Trump extended the pause through December 31 and the Department of Education extended it again until January 31.

In addition to providing some certainty for borrowers and servicers, the October 1 timing ensures that borrowers’ tax refunds won’t be at risk of being seized. The government has the ability to offset borrowers’ Earned Income Tax Credit or other tax refunds over defaulted student loans.

Last year, because the freeze on student loan payments and collections was put in place so close to tax season, there was “still friction” in turning off the tax offset system, Yu said, and some borrowers had their tax refunds seized by the government even after the pause took effect. Waiting to resume payments and collections until at least October of this year mitigates the risk of a similar situation taking place again, she said.

Yu said she’d like to see policymakers take the time offered by the student-loan payment pause to consider reforms to the collection system, including preventing the seizure of the EITC and Social Security benefits and fixing the suite of programs borrowers can use to repay their debt as a share of their income.

Though many borrowers will continue to see pandemic-related student loan relief, millions will likely still be left out of the pause on payments and collections. Biden plans to direct the Department of Education to extend the pause on federal direct loans, according to documents from the transition. That means that borrowers with private student loans and those with federal student loans held by banks and guarantee agencies — an estimated 9 million borrowers — are still required to make payments on their loans.

“It’s really frustrating that policymakers keep leaving out,” these borrowers, Yu said. “There’s no good reason why they should be treated differently just because of when their loans were taken out or who their school chose to be their lender at the time.”

In addition to including those borrowers in any payment pause, advocates and mainstream Democrats have been calling for more dramatic action on student loans. In September, Senate Democrats Chuck Schumer and Elizabeth Warren urged the next president to use executive authority to immediately cancel up to $ 50,000 in student debt. Some activists have called for Biden to cancel all student loans.

Debate has raged since Biden’s election over the idea of debt cancellation broadly and whether Biden should do it or leave it to Congress instead. Biden transition officials have said he supports Congress immediately cancelling $ 10,000 in student debt, though there was no mention of student loans in the coronavirus and economic relief plan the administration released last week.

“This is a big relief, but it is not the end of what we need,” Yu said, noting that the payment pause allows for “breathing room” to consider major changes to the student loan system. “Ultimately we need cancellation and we need to make sure that all borrowers are included in that cancellation,” she said.