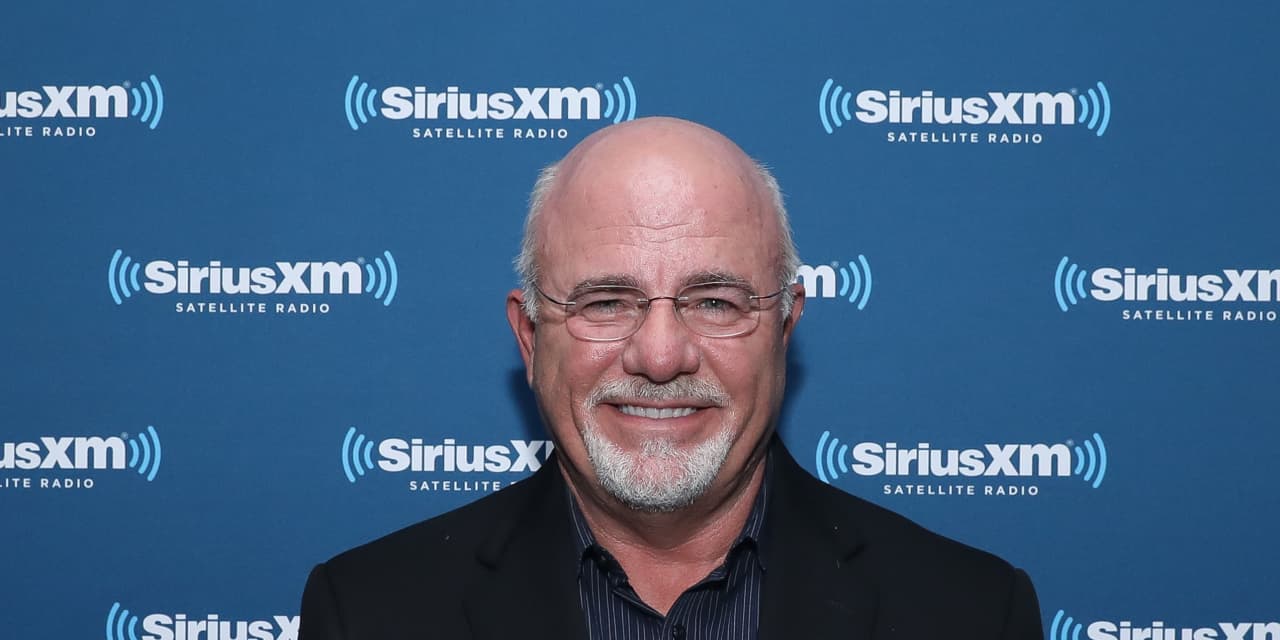

Personal-finance guru Dave Ramsey says people need a $ 1,000 emergency fund. He also says that if a $ 600 or $ 1,400 stimulus check would be a lifeline for you during the current pandemic state of emergency, “you were pretty much screwed already.”

The radio host and author argued against President Joe Biden’s proposed round of stimulus checks while speaking on Fox News on Thursday, telling “America’s Newsroom” that “I don’t believe in a stimulus check.”

“ ‘If $ 600 or $ 1,400 changes your life, you were pretty much screwed already. You got other issues going on.’ ”

“You have a career problem. You have a debt problem. You have a relationship problem. You have a mental-health problem,” he continued. “Something else is going on if $ 600 changes your life.”

Watch it here:

He hastened to say that he was “not talking down to folks” — as he’s been bankrupt himself and he helps people who are hurting financially every day.

But he argued that government stimulus checks are just throwing money at a problem, rather than fixing the underlying issues.

Or, as he colorfully put it, this is “peeing on a forest fire. It’s absolutely ridiculous.”

A video clip of his stimulus remarks went viral on Twitter TWTR,

Others accused him of ignoring the systemic inequalities across the country that were already widening the wealth gap and keeping minorities, women and low-income Americans in poverty before anyone even heard of COVID-19, and which have only been exacerbated by a deadly pandemic that continues to see more than one million applications for unemployment benefits being filed each week.

Prior to the pandemic, many Americans were already in a precarious financial position; a 2018 Federal Reserve Board Economic Well-Being report found that four in 10 Americans couldn’t cover a $ 400 emergency expense, and a CNN report that same year found that one in four Americans had no emergency fund whatsoever.

The coronavirus pandemic has only compounded that problem. Indeed, Ramsey’s most prolific nugget of personal-finance advice — that those paying off debt keep a $ 1,000 starter emergency fund — has become obsolete. Many people struggling to make ends meet have remarked on Reddit that socking away three to six months’ worth of essential expenses in case of an emergency ran out long ago, and stimulus checks and unemployment benefits have been key to keeping their heads above water.

Read more: The pandemic has thrown this treasured piece of financial wisdom out the window

Many people on Twitter likened Ramsey’s “you were pretty much screwed already” response to withholding food or water from a dying person, since they were already a goner.

“If you’re already struggling, just throw away the whole person,” wrote one critic.

Ramsey’s supporters argue that he has a point: that the country’s underlying financial weaknesses can’t simply be solved by a couple of stimulus checks.

In the meantime, millions of Americans are waiting with bated breath to see whether they will be getting $ 1,400 stimulus checks as part of President Biden’s proposed $ 1.9 trillion COVID-19 relief package. Most of the people who received a $ 1,200 direct payment last year as part of the $ 2.2 trillion CARES Act spent those first stimulus checks to pay bills, according to a YouGov survey.

“It’s alarming to look at how many Americans used these funds to keep a roof over their head and pay for necessities,” the report said.