So much has been made of Tesla’s breathless rise to mind-boggling valuations in 2020. But the stratospheric rise of the Palo Alto, Calif.-based company also might have a broader impact on the overall markets, not just Tesla or the nascent electrical vehicle market, notes one Deutsche Bank strategist.

The share rally for Tesla TSLA,

Check out: Tesla to pause Model S, Model X production for 18 days: report

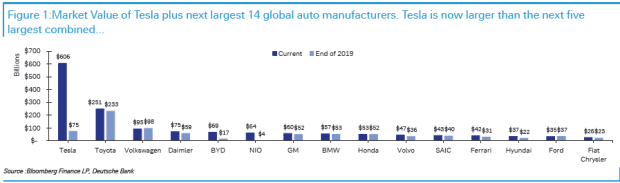

Deutsche Bank’s Jim Reid attempts to put the company’s moves into some perspective, pointing to the obvious fact that Tesla has stood out this year: “it has increased +704% and is now larger than the next five largest global auto companies combined.”

Its gargantuan size has been discussed ad nauseam, but Reid suggests that going into next year, particularly as Tesla is included in the S&P 500 index SPX,

See: Tesla joining the S&P 500 is ‘mother of all’ stock-market events

“In a remarkable 2020, Tesla might just be the most remarkable market story of them all,” the strategist wrote in a Tuesday note.

“Given its colossal size and that of the tech sector, their paths in 2021 will probably be a big macro driver of markets. Investors in all asset classes might have to assess whether valuations are justified and sustainable,” he writes.

Read: Opinion: Nio, not Tesla, is the better EV stock pick for 2021

Therein lies the rub for fans of Tesla, particularly with its price-to-earnings ratio that stands at 1,278, according to FactSet data. Put simply, the P/E is an asset’s share price divided by earnings per share.

The average LTM or, earnings over the last 12 months, for the S&P 500 was 26.79. In other words, investors have been willing to pay $ 26.79 for every $ 1 of earnings of an average S&P 500 component, but were willing to shell out roughly $ 1,300 for every $ 1 of earnings produced by Tesla over the past year.

That is pricey.

Overall, Tesla’s shares have risen more than 656% so far in 2020, as of Tuesday’s close. Meanwhile, the Dow Jones Industrial Average DJIA,

Few assets, however, have compared with Tesla in 2020. The question worth asking now is whether Tesla can drag the market up down in the coming year.