What just happened?

When the Barstool bull crashed through the ETF china shop, it was both upsetting and, if we’re being honest, a little titillating.

You just don’t do that in financial services, was the initial reaction to Dave Portnoy’s shenanigans. Then everyone poked fun at the newby who didn’t know the basics, like how you have to wait until a certain threshold before your fund gets traded widely.

But then some serious questions followed.

In the end, it may turn out that having such a big messy disruption in the middle of an industry that’s been doing things one way for a while might not be the worst thing. As ETF Wrap noted a few weeks ago, that would be ironic, given that many ETF industry participants have long considered themselves the brash upstarts in a world of staid Wall Streeters.

Still, there’s been a surge of interest among retail investors in smaller, theme-oriented disruptive ETFs even as suspicion of the behemoth asset managers lingers on issues like devising “ESG” portfolios as varying versions of FAANG stocks, to smothering creativity, or outright stealing ideas.

In the case of the Portnoy-backed ETF BUZZ,

Thanks for reading.

Step right up!

Here at ETF Wrap, we like to encourage the free exchange of ideas about… you guessed it… ETFs. And what better way to do that than to encourage you to freely share your ideas about new ETFs.

To that end, we’ve decided to run the First Annual Totally Unofficial Completely Unserious ETF Idea Contest.

The rules for the FATUCUEIC are just as straightforward as its name. Submit your idea for a new ETF! We’ll pick one winner and one runner-up and write about them in an upcoming issue!

The fine print: the contest opens for entries on March 18, 2021, and closes at the end of the day on March 25, 2021. Send entries to this address. An entry need not be long, but it should have as much information about the idea as we need to evaluate it:

What is its investment thesis? Who is the intended audience? What gap in the market does it fill? How would it execute on those ideas? What types of assets would it hold? What ticker would you like it to have?

We are very lucky to have as our judge ETF veteran Amrita Nandakumar, currently president of VIA Investment Advisory, a boutique asset manager which provides portfolio management and trading services to sponsors of index and active investment strategies, including ETFs. Previously, Nandakumar spent seven years at Van Eck in ETF product management and strategy and corporate development roles, and before that several years at Vanguard. She holds her FINRA Series 24, 7, and 63 accreditations and a leadership role with the New York Chapter of Women in ETFs.

The prize for the winner of the FATUCUEIC will be a mention in these pages, and the prize for the runner-up will be a (smaller) mention in these pages.

If you have any questions, don’t hesitate to reach out to this address. It should go without saying that a “totally unofficial completely unserious” contest is meant for fun and entertainment purposes only, and that while MarketWatch, ETF Wrap, Dow Jones, News Corp., and Nandakumar, her aunts, uncles and any pet goldfish she may or may have will hold no claim to any intellectual property you decide to share, neither can we guarantee its secrecy.

Once again: submit your ideas by 11:59 Eastern on March 25, 2021, to this email address, ideally with the email subject header ETF Wrap Contest. Good luck!

Exchange-traded sundries

Why do people love talking about Cathie Wood so much? See: Why Do Some People Hate Cathie Wood? by Michael Batnick

After Tesla was added to the S&P 500 late in 2020, ETF ownership of its shares grew to 7%, according to a Financial Times story. But the company’s claim to being eco-friendly is now under fire because of its investment in Bitcoin. That may cost it some weighting among ESG-oriented funds.

Stance Capital, a Boston-based investment advisor with a focus on ESG, has transitioned its separately managed account strategy into a not-fully-transparent ETF. As of the end of 2020, the Stance Equity ESG Large Cap Core separate account composite returned 13.38% average annualized net returns since inception in January 2014, compared to 12.92% for the S&P 500 Total Return Index. The new ETF STNC,

The Invesco QQQ Trust QQQ,

A focus on income significantly understates how bad American inequality is, a situation made worse by monopolies that develop in important service sectors like the housing market, education, health care, and, yes, financial services, all of which contribute to wealth and wealth inequality, according to a new Minneapolis Fed working paper.

Is there an ETF for that?

The investing world has spilled lots of ink trying to determine which lockdown trends will persist into 2021 and beyond: how much will we Zoom, shop for groceries online, or Netflix NFLX,

But of all the life changes brought about by the coronavirus, the mass adoption of pets may be one of the more endearing — even enduring.

“This is an under-the-radar, working-from-home investment theme because people will still be spending time at home even as the economy starts to open up,” said Todd Rosenbluth, head of ETF and mutual fund research at CFRA. “This is a potentially more resilient way of investing in the new normal.”

As we know, every dog, and seemingly every investment theme, has its day. The ETF for this one is the ProShares Pet Care ETF PAWZ,

While consumer-facing pet brands are paw-lentiful, PAWZ is laden with plenty of stocks that may not be as familiar. In fact, a good chunk of the portfolio is devoted to health-care names like IDEXX Laboratories, Inc. IDXX,

As ProShares explains in an investment case analysis on its web site, “more and more, owners are caring for pets like family.” Among other things, we’re providing them with health care “comparable to our own.”

“For many people, the pet is the first child, and many people are inclined to spoil their pets,” Rosenbluth said in an interview. Rosenbluth, ordinarily a very good boy, declined to respond to an ETF Wrap inquiry about whether he speaks from first-hand experience.

More to the point, Rosenbluth added, “I think people are also realizing the cost of owning a pet. It’s likely people are focusing more on how to more cost effectively have the pet be a member of the family for years to come.”

One more pupdate: many American households are about to get a windfall from the $ 1.9 trillion coronavius aid bill, and more than a few will likely spend it on their pets.

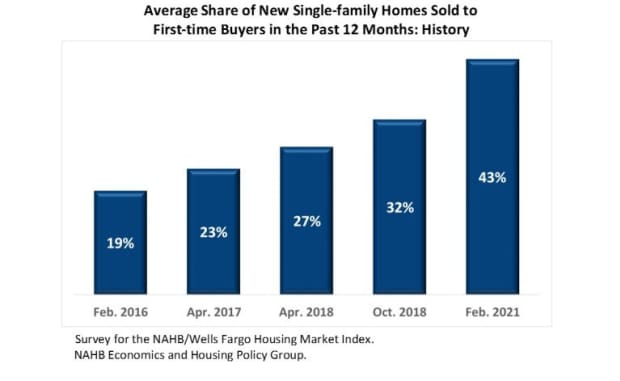

Visual of the Week

Weekly rap

| Top 5 gainers of the past week | |

| Breakwave Dry Bulk Shipping ETF BDRY, | 17.5% |

| Global X Uranium ETF URA, | 13.6% |

| Cannabis ETF THCX, | 10.6% |

| Global X Cannabis ETF POTX, | 9.5% |

| Amplify Seymour Cannabis ETF CNBS, | 8.6% |

| Source: FactSet, through close of trading Wednesday, March 17, excluding ETNs and leveraged products | |

| Top 5 losers of the past week | |

| SPDR S&P Oil & Gas Equipment & Services ETF XES, | -8.5% |

| VanEck Vectors Oil Services ETF OIH, | -7.7% |

| Invesco Dynamic Oil & Gas Services ETF PXJ, | -7.4% |

| iShares U.S. Oil Equipment & Services ETF IEZ, | -7.1% |

| Invesco S&P SmallCap Energy ETF PSCE, | -4.9% |

| Source: FactSet, through close of trading Wednesday, March 17, excluding ETNs and leveraged products | |

MarketWatch has launched ETF Wrap, a weekly newsletter that brings you everything you need to know about the exchange-traded sector: new fund debuts, how to use ETFs to express an investing idea, regulations and industry changes, inflows and performance, and more. Sign up at this link to receive it right in your inbox every Thursday.