There’s one commodity that’s seen a phenomenal gain in prices this year that may have been missed by some investors: rhodium’s value has climbed by more than 50%, extending a rally that saw prices for the metal nearly triple in 2020.

Traders haven’t paid more attention to rhodium’s phenomenal rise because it isn’t traded on the exchanges, says Nick Jonson, senior editor, markets, at S&P Global Platts. “It has less visibility for most trading houses and banks.”

The market is also much smaller than those for platinum PLN21,

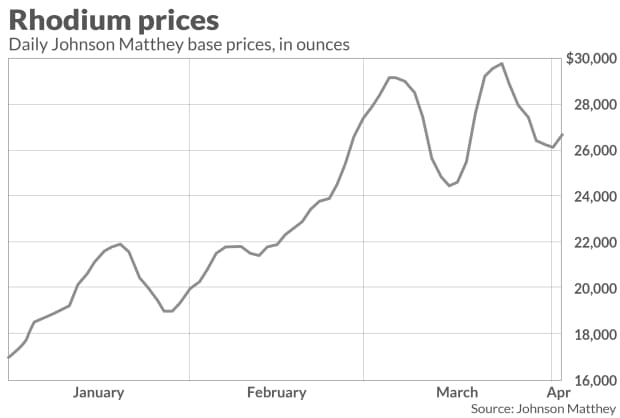

Rhodium is known as the rarest of the PGMs and is mostly used in emission-controlling automobile catalytic converters, but also as an electrical contact material and as a catalyst in making nitric acid. Spot prices for the metal touched a record high on March 23 at $ 29,800 an ounce, based on data from John Matthey. It gained around 180% last year.

Peter Thomas, senior vice president at Zaner Precious Metals, attributes the metal’s rally to processing challenges, including its high melting point of 3,567 degrees Fahrenheit, as well as strong demand that has outpaced supplies.

Rhodium saw a supply deficit of 84,000 ounces in 2020, just about doubling its deficit from 2019, as tight supplies “greatly exceeded” declines in autocatalyst and industrial demand, according to Johnson Matthey.

Tightening emissions standards in China, Europe, India, and elsewhere require more rhodium in catalytic converters to control greenhouse gas emissions, says Jonson. Production in South Africa, meanwhile, slowed with miners forced to close during last summer to stop the spread of Covid-19, he says.

Covid-19 shutdowns caused cargo flight delays from South Africa, compounding the situation, says Jonson. In 2020, two Anglo American Platinum ANGPY,

Rhodium prices are trading 57% higher year to date, having eased back in recent days to $ 26,700 on April 1, down 10% from their recent peak, according to data from Johnson Matthey.

Market sources say consumers of the metal in Asia are very price sensitive and “were not aggressive buyers” as prices approached $ 30,000, says Jonson.

Global auto demand may be picking up, but the semiconductor chip shortage has forced auto producers to scale back or eliminate production at certain plants, which could weigh on short-term rhodium demand, he says.

As 2030 nears, production, affordability and popularity of battery-electric and fuel-cell vehicles will likely grow, which, Jonson says, “don’t require catalytic converters.”

Still, the metal is likely to be a key component in autocatalysts for gasoline and diesel-power vehicles near term, given the rise in global emissions standards, he says.

For those who wish to invest in the market, options are limited given rhodium’s rarity. While the metal isn’t traded on a futures exchange, the Xtrackers Physical Rhodium exchange-traded commodity XRH0,

Prices still have room to rise this year, with Zaner Precious Metals’ Thomas seeing a climb to $ 30,000 as a “real possibility” by the end of the year—and higher if the infrastructure bill passes in the U.S.