2020 is expected to go down as one of the best years for the mortgage industry since 2003. This week the Mortgage Bankers Association released its forecast for the remainder of 2020 and into 2021. The group predicts mortgage originations will increase to $ 3.18 trillion in 2020. That’s the …

Read More »Don’t be frightened by home loan lingo! Part 1

Take today’s attractive mortgage rates, sprinkle in a housing inventory that’s in short supply and and an up-and-down economy and it’s a a wild time to be in the market for a new home. Have no fear, homebuyers! Even though the world of mortgage lending can be a scary place …

Read More »Government Home Loan Programs

Government Home Loans Min Credit Score Down Payment Max DTI Ratio Income Limit No down payment No down payment 115% of area median income Rate Search: Check Rates and Compare Loans Offers What is a Government Home Loan? There are two types of home loans, conventional and government loans. A …

Read More »Interest rates hit historic low for tenth time this year

Mortgage interest rates have once again hit a historic low. This week’s Freddie Mac average for a 30-year fixed-rate mortgage dipped to 2.81%. This time in 2019, the average rate was 3.69%. In 2018? We saw an average of 4.85%. Despite the historically low rates, mortgage applications went down this …

Read More »Pre-qualified vs. Pre-approved. What’s the difference?

Before jumping headfirst into the housing market, a prospective homebuyer will have a general idea of where they want to live, how they want to live and how much home they can afford. And when you start to shop around for a lender and look at mortgage options, you’ll begin …

Read More »FHA Home Inspection Checklist & Requirements

Some sellers may be hesitant to accept offers from buyers using an FHA loan because they have stricter property standards than conventional loans. In some cases, sellers need to make repairs to the home to pass an FHA home inspection. FHA home inspections are performed to make sure buyers are purchasing a safe and livable house. Rate …

Read More »How to use gift money for your mortgage down payment

All this remote working stuff might have you thinking what many others are thinking, “Why am I paying high rent to live within an easy commute to the office when I can live anywhere?” And if you can live anywhere, you can probably also afford a monthly mortgage payment. It …

Read More »Market volatility spurred by Congress, housing demand stays strong

The continued back and forth in Washington has pushed the stock market into continued volatility this week. President Trump’s comments on Wednesday that legislators were “starting to have some very productive talks” about a new federal economic support plan spurred Wall Street to its best finish since July. The Dow …

Read More »What is APR and How it Affects Your Mortgage

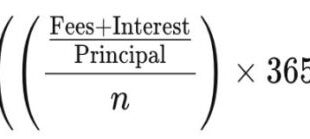

What is the APR? The annual percentage rate (APR) is the interest charged annually on loans and lines of credit. The APR rate is higher than the interest rate because it takes all additional costs and fees into account to give you the true interest rate. The annual percentage rate …

Read More »