Money managers who use environmental, social and governance factors in their investment analysis say climate change continues to be their top concern and the leading criteria as they put money to work.

The amount of professional money managed using all three ESG criteria rose sharply, according to a group that measures this type of investment, and now represents 33% of the $ 51.4 trillion in total U.S. assets under professional management.

US SIF Foundation’s 2020 biennial “Report on US Sustainable and Impact Investing Trends,” released Monday, shows that sustainable investing assets now total $ 17.1 trillion, a 42% increase over 2018. Sustainable investing covers a wide swath of investing to consider both financial return and social and environmental good. It can cover anything from reducing harmful impacts on the environment, to fair labor practices to promoting independent corporate board governance. Some sustainable investing also can seek to have a positive impact on communities in need.

The report provides data on the U.S. asset management firms and institutional asset owners using sustainable investment strategies and examines the ESG issues they consider in managing their portfolios. The foundation conducted research on 384 money managers, 1,204 community investing institutions and 530 institutional asset owners.

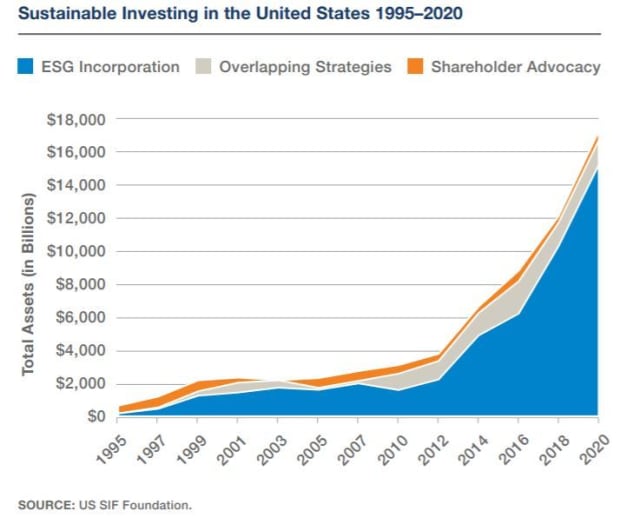

US SIF has published the report every two years since 1995, when sustainable assets totaled $ 639 billion. Since then, sustainably invested assets have grown at a compound annual growth of 14%, with the most rapid growth happening since 2012.

In asset-weighted terms, climate change is the most important specific ESG issue cited by money managers who invest both institutional and individuals’ money, with $ 4.2 trillion devoted to this issue, a rise of 39% from 2018.

Because money managers may not disclose their clients, the foundation also directly reaches out institutions for transparency on their ESG investments. Among institutions, which include institutional asset owners, insurance companies and retirement plan sponsors, climate change remains the most important environmental issue, at $ 2.6 trillion, a rise of 17% over 2018.

Insurance companies and educational institutions cite climate change as their top ESG investment focus overall.

Meg Voorhes, director of research at US SIF, says that when the foundation surveyed money managers, it defined climate change as a focus on the risk and the opportunities to reduce greenhouse gas and carbon emissions. Respondents could also mention separately what other environmental investments they made help to mitigate climate change, such as fossil-fuel divestment, investing in green buildings/smart cities and clean technology, she says.

Investments to mitigate climate change

Individual investors who want to follow these trends have plenty of choices as the environment is the biggest category when it comes to ESG investing, whether in individual stocks, exchange-traded funds or mutual funds.

When comes to specifically reducing carbon emissions and greenhouse gases, a few ETFs stand out. Etho Climate Leadership ETF ETHO,

Performance-wise, the ETF lags the midcap growth category and index because it is overweight financial services and industrials, two sectors that were hit hard in 2020, but still has returned an annualized total 15% on a three-year basis.

A carbon-focused ETF that made its debut earlier this year is KFA Global Carbon ETF KRBN,

The ETF’s benchmark is the IHS Markit’s Global Carbon Index. This index gives exposure to cap-and-trade carbon allowances by tracking the most liquid carbon-credit futures contracts. Interested investors should be aware it’s a small fund with only $ 12 million in assets under management.

There are two other ETFs that have low-carbon in their name, iShares MSCI ACWI Low Carbon Target ETF CRBN,

Clean-energy ETFs offer investors a way to help mitigate climate change. Two highly rated and strong-performing ETFs with sustainability mandates are Invesco WilderHill Clean Energy ETF PBW,

Both ETFs include companies involved in wind, solar, biofuels and geothermal companies, and both have Chinese electric vehicle company NIO NIO,

Another avenue for investing is to look at the biggest producers of greenhouse gas emissions and what publicly traded companies may be in a position to mitigate those emissions.

Older buildings are notorious leakers of energy. These structures contribute nearly 40% of annual global greenhouse gas emissions, according to Architecture 2030, a group that seeks to reduce the carbon footprint of buildings, and approximately two-thirds of those buildings will still exist in 2050. Retrofitting existing structures with better insulation can help reduce an old building’s carbon footprint.

Toward that goal, consider these three leaders in the building products division: Owens Corning OC,

As interest in climate change mitigation and reducing greenhouse gases grows, investors may have more options to consider, but like with any investment, they should do their own research.

Debbie Carlson is a MarketWatch columnist. Follow her on Twitter @DebbieCarlson1.