The view from a Brooklyn neighborhood on Tuesday. The UBS report gave a mixed picture for New York City real estate.

Getty Images

The coronavirus pandemic may have triggered the worst global downturn in more than 60 years, but home prices in the world’s biggest cities still have shot higher into the stratosphere.

Instead of a plunge, it’s been four quarters in a row of home-price growth for major cities, as governmental fiscal support and central banks’ monetary policies have kept the party going, according to a new UBS Global Wealth Management report.

As a result, it still would take 20 years for a highly skilled service worker to be able to buy a 650-square-foot apartment near Hong Kong’s city center, according to its findings.

In Paris, it would take about 17 years of work to buy a similarly sized property, while in New York City it runs closer to 11 years.

As a reference point, 650 square feet would be about double the size of a school bus converted into a tiny abode.

It’s likely unsustainable. That’s a key takeaway of the report from Claudio Saputelli and Matthias Holzhey, real-estate analysts at UBS Global Wealth Management, which looked at home prices in 25 major cities worldwide for its UBS Global Real Estate Bubble Index 2020.

The report urges investors to be on guard for a “correction phase” in global housing markets as pandemic stimulus wears off and household income gets pressured lower.

Read: House Democrats set to vote on own $ 2.2 trillion stimulus bill as talks sputter

“To what extent higher unemployment and the gloomy outlook for household incomes will affect home prices is uncertain at this point,” they wrote. “However, it’s clear that the current acceleration is not sustainable.”

Although real estate can help create generational wealth, “now is certainly not the worst time for owners of multiple properties to consider profit-taking,” according to the team.

Specifically in the U.S., the picture looks cloudy for owners of rental residential properties in coastal urban areas, including San Francisco and New York, where the pandemic has accelerated the trend of remote workers looking for cheaper places to live.

Read: Rents are softening nationwide — but here’s where they are falling the most

A surge in tech jobs in San Francisco, as well as capital raised through initial public offerings, still has property prices 65% above their bottom in 2012, even though valuations have fallen for a second year in a row, due to falling home prices, the report notes.

See: IPO market is headed for busiest third quarter since the dot-com years

The UBS team thinks “a bubble risk is off the table for now” for San Francisco, but also underscored how the pandemic put a spotlight on the affordability crisis in the City by the Bay. Furthermore, immigration restrictions have dented demand for short-term rentals and “further contributed to the housing market’s weakness.”

In Manhattan, slumping property-price growth will hinge on the fate of the city’s large financial services industry and oversupply of luxury properties. But for New York City as a whole, the analysts highlighted “mounting local economic and social challenges,” as a threat, as well as rising tax rates and migration to the suburbs.

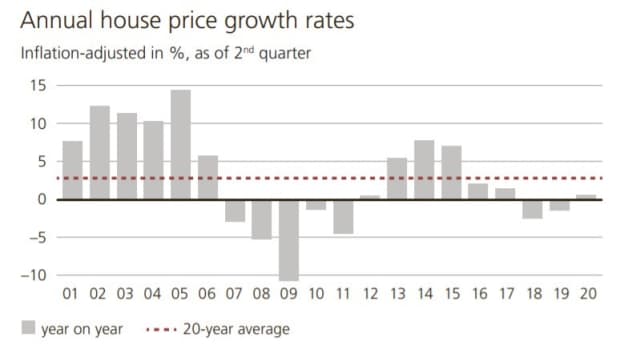

New York City’s home price growth

UBS Global Real Estate Bubble Index

“In our view, New York will stay relatively attractive to wealthy investors beyond the pandemic,” the team wrote. “That said, homeowners are likely to see the pandemic’s adverse impact on property values for the foreseable future.”